The rise of AI in insurance underwriting marks one of the most significant transformations the insurance industry will experience in 2025. With rapid advancements in data volumes, the risk of breaches also increases. For this reason the insurance organizations are now looking for automated processes instead of just relying on manual work. The speed and accuracy that is provided by AI makes the organizations operate efficiently in a competitive market. The AI adoption within the insurance organization will only grow if it shapes the way carriers identify, assess, and act on underwriting opportunities.

The Shift to Intelligence

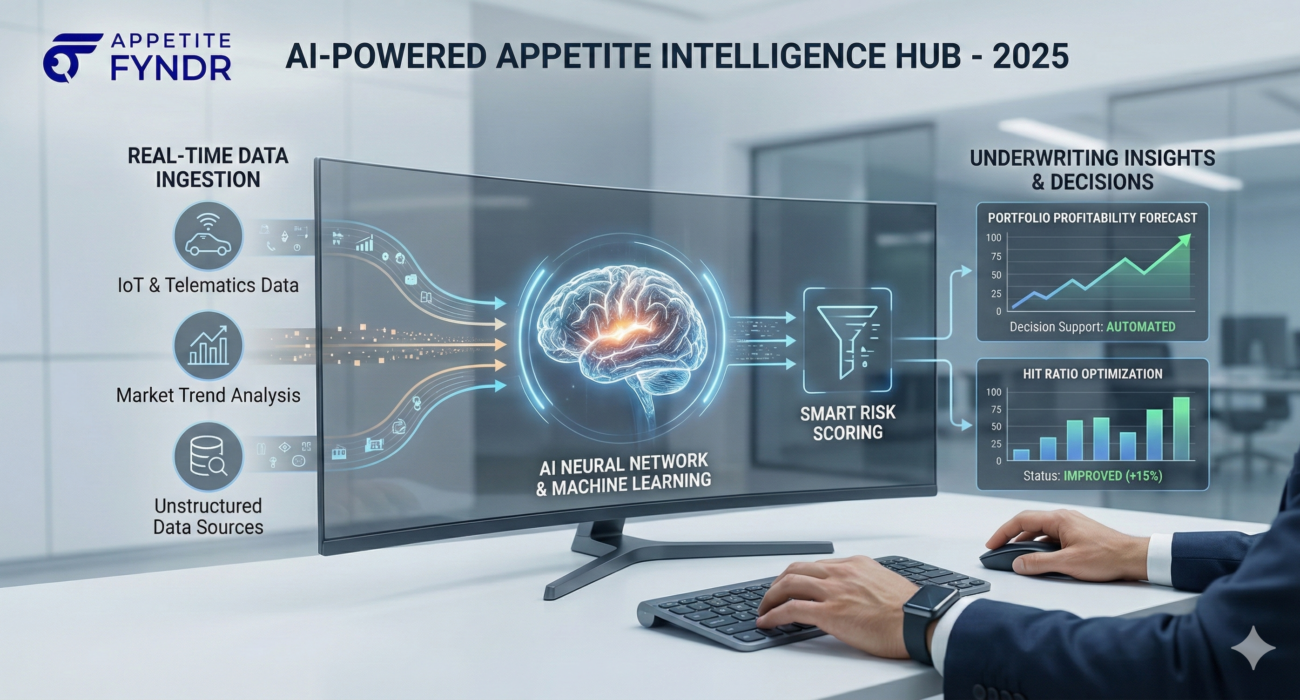

Underwriting once relied on manual assessments and historical experience, but today’s landscape demands deeper insights. Organizations require faster evaluations and clearer visibility into risk. This is where smart appetite intelligence plays a critical role, enabling teams to align risk appetite with real-time market signals.

This transformation helps carriers move beyond static guidelines. When AI-driven intelligence embeds into underwriting processes, the risk selection becomes more consistent, scalable, and profitable.

AI-Powered Matching

Modern carriers are increasingly turning to AI-powered appetite matching to strengthen their underwriting operations. These advanced systems analyze thousands of data points to align risks with the right appetite profiles. As a result, carriers reduce misaligned submissions and improve their hit ratios.

Matching technology is becoming essential for both growth and efficiency. It enables teams to focus on qualified opportunities and reduces time spent reviewing irrelevant risks.

Smarter Underwriting Insights

AI-enhanced underwriting insights provide a clear view of trends, emerging exposures, and evolving risk categories. These insights help teams evaluate submissions faster and maintain the accuracy levels. The ability of the underwriters to make better decisions is significantly enhanced with a deeper analysis performed through AI.

These insights also empower teams with better context. By integrating external and internal data sources, underwriting decisions become both proactive and informed.

Data-Driven Decisions

The move toward data-driven underwriting decisions established a new era of strategic intelligence for insurance carriers. AI tools analyze large datasets to highlight correlations and risk signals that may not be immediately visible to human underwriters. It will result in enhanced quality submissions and creates stronger portfolio management related to loss ratio performance.

Data-driven practices also help organizations uncover hidden opportunities. With the help of AI carriers can identify segments where they can grow sustainably while staying aligned with their appetite.

AI Tools for Carriers

Many organizations are accelerating adoption of AI tools for insurance carriers to manage underwriting demands. Different tasks such as risk assessment, appetite management, operational automation, and portfolio analytics can be managed with these tools. They also create unified visibility across departments and enable teams to work with greater focus and precision.

Carriers who use these tools are better positioned to respond to competitive pressures. As more insurers adopt AI at scale, digital maturity becomes a defining factor in market leadership.

Underwriting Transformation

Digital underwriting transformation is reshaping the operational needs that are now transforming the manual workflows. The automated systems that deliver the real-time decision to streamline underwriting needs.. This helps underwriters reduce administrative tasks and redirect attention toward strategic analysis.

This transformation not only increases the speed of underwriting but it creates more resilient and adaptive operations. Digital workflows enable carriers to innovate continuously as the market evolves.

Assisted Workflows

Many insurers are integrating AI-assisted underwriting workflows into their daily operations. The tasks such as data extraction, document review, and preliminary risk scoring are now being managed through these workflows.

This collaboration between humans and AI enhances productivity without compromising judgment. The combination of automation and expertise creates a stronger, more scalable underwriting strategy.

Supporting Automation

Advanced tools are supporting automated underwriting systems by providing structured data and predictive intelligence. These systems help carriers evaluate simpler risks automatically while routing complex cases to human underwriters. This two-tier approach increases efficiency and reduces backlogs.

Automation ensures that organizations can operate at scale without missing accuracy and consistency. It also positions carriers to deliver faster response times to brokers and clients.

Predictive Insights

One of the most valuable advancements in 2025 is the rise of predictive appetite insights. Carriers can easily analyze which risks will align with their appetite before submissions are even received. It helps the organizations in proactive-decision making and stay ahead of their competition.

Predictive analytics can also identify where appetite may need adjustment and reveal growth opportunities. This makes underwriting strategy more dynamic and better aligned with real-time market needs.

AI for Risk Assessment

The adoption of insurance risk assessment AI is helping carriers evaluate exposures more accurately. AI models can assess risk factors such as industry characteristics, geographic exposure, and historical claims patterns. This leads to more precise pricing and improved underwriting discipline.

Risk assessment AI strengthens carrier portfolios by ensuring each risk is evaluated systematically. With stronger visibility, carriers can balance growth with profitability.

Stronger Carrier Strategy

Organizations using AI at a larger scale are rethinking how they manage risk. With the help of AI insights the decision makers can refine appetite and identify more profitable niches. It means that the executives don’t have to solely rely on historical data but can incorporate the real-time intelligence into their strategies.

In 2025 the carriers become more agile because of stronger analytics and automated tools. From this it is clear that the underwriting function is not just an operational workflow but turned into a strategic engine.

Efficiency and Accuracy

AI strengthens both efficiency and accuracy across underwriting teams through reducing the manual errors and improved decision-making through real-time insight. They create a process which is not only faster and transparent but also aligned with the business objective.

Any carrier that wants to differentiate it from the conventional ones can transform the operations in a similar manner. And AI enables this by elevating productivity without sacrificing quality.

The Future of Underwriting

The future of AI in insurance underwriting is defined by AI models becoming more advanced. This advancement includes underwriting decisions that rely increasingly on predictive capabilities and appetite-driven insights. So the carriers that adopt AI early are positioning themselves for better growth, profitability, and responsiveness.

Organizations that invest in modern AI technologies will unlock more strategic value from underwriting. And this shift is no longer optional but it’s essential for maintaining relevance in a changing industry.

Conclusion

The rise of AI in insurance underwriting is reshaping how carriers assess risk and drive profitable growth. As 2025 unfolds, organizations that embrace smart appetite intelligence and AI-powered decision support will lead the next wave of industry transformation.

Now is the best time for carriers and agencies to look for the tools and platforms that can restructure the underwriting. The businesses that invest today will gain a lasting advantage tomorrow.