Insurance companies have embraced technology as a way to streamline their operations and enhance the customer experience.

The technology can automate processes like quote generation, policy issuance and claim processing. More and more insurance firms are investing in the development of custom insurance software.

Insurance companies can develop custom software to meet their needs by using customized insurance software.

Custom insurance software offers a wide range of capabilities to help businesses manage risks and improve customer service.

Insurance software can help insurers reduce costs and streamline operations to stay competitive.

Custom software offers features such as automated policy renewal and issuance, enhanced customer service, and automated claim filing.

Insurance software can be customized to suit the needs of any company, from life insurers and funeral coverage providers through to truck cover and property insurers.

An insurance software can be a valuable asset for any insurance company.

CoverWallet's cargo insurance is a good example of how a custom software for insurance can help. These allow insurers to efficiently manage the risks associated with their truck cargo. It also offers comprehensive coverage that meets the specific needs of their customers.

Every insurance company can benefit from the following key features of custom software for insurance.

Insurance companies can streamline their operations and automate processes with the right custom software. Insurance companies, for example, can automate tasks such as insurance quote processes and policy renewals.

This can lower manual labor costs and improve customer service.

Custom insurance software helps organizations better manage risk through predictive analytics and machine-learning algorithms.

Companies can develop strategies for mitigating risks by utilizing data from multiple sources.

Insurance companies can provide information to their customers about their products and service in a format that is easy to understand by using custom software.

Customers can now easily understand and compare their coverage to make informed decisions.

Insurance companies can benefit from custom software to help them comply with various laws, standards, and regulations that govern the industry.

Companies can meet all requirements by implementing a comprehensive management system.

Dental insurance in Florida is a good example of how custom-made software can be helpful. State regulations specify what services are covered by dental plans. Custom software designed for the Florida market will include these services in its standard coverage options, ensuring compliance with state law.

Custom insurance software can help organizations provide better customer service. They have a digital platform that allows them to communicate with customers more quickly and easily.

It can be a great way to build relationships with clients and give them an efficient way to address their needs.

Insurance software can be integrated with CRM and support systems to make it easier to track and monitor customer queries and to respond in a timely fashion.

Standard software solutions are limited in their options. Custom software is more flexible. It allows companies to customize the software to their specific needs rather than settling for a standard solution.

As business grows, so do their requirements. Custom insurance software allows insurers to add or remove features as they see fit, keeping their system up-to-date with their changing needs.

Customized insurance software provides tighter safeguards and protections than traditional software. This software is designed to offer the highest level of data protection for businesses and organizations.

This software allows businesses to protect their data against external threats, such as malware, hackers, data loss and unauthorized access.

This software offers advanced encryption to ensure that all data is stored securely and protected against malicious attacks.

Custom software for insurance can be designed to streamline the process by allowing it to perform tasks and transactions related with insurance quickly.

Insurance providers who are able to complete processes faster can attract new customers and secure more deals. This can result in improved customer satisfaction.

Imagine you are running an insurance agency and you feel overwhelmed. You and your team are juggling many tasks, such as handling claims, maintaining customer data, or keeping up with paperwork. You're trying to spin a lot of plates at once. A single slip could lead to a mess!

Custom Insurance Software can help. Imagine it as a personal superhero who swoops into action to save the day. Here's how:

You don't need to use five different software systems to accomplish a single task. All your information can be gathered in one location, like a Swiss Army Knife for your insurance company. You can access all the information you need, whether it is to retrieve customer data or process claims.

Software is not a one-size fits all deal. This software is built specifically for you. You can add the security features you want. Imagine creating a fortress to protect all of your data. You can control the drawbridges, the moats, and the guards.

Do you know how much time you waste on data entry, shuffling paper and other tasks? Custom software can automate this. Imagine a robot assistant who takes care of all the tedious tasks so that you can concentrate on important decisions.

Insurance claims can be stressful, and no one wants to wait. Your customers will love the ease of checking their claim status with custom software. You're giving them the equivalent of a fast-pass to an amusement park. They'll be grateful!

Data is coming from everywhere: customer surveys and claim statistics, etc. All that data can be put into easy-to read reports by your custom software. You can make predictions and spot trends without needing to have a PhD.

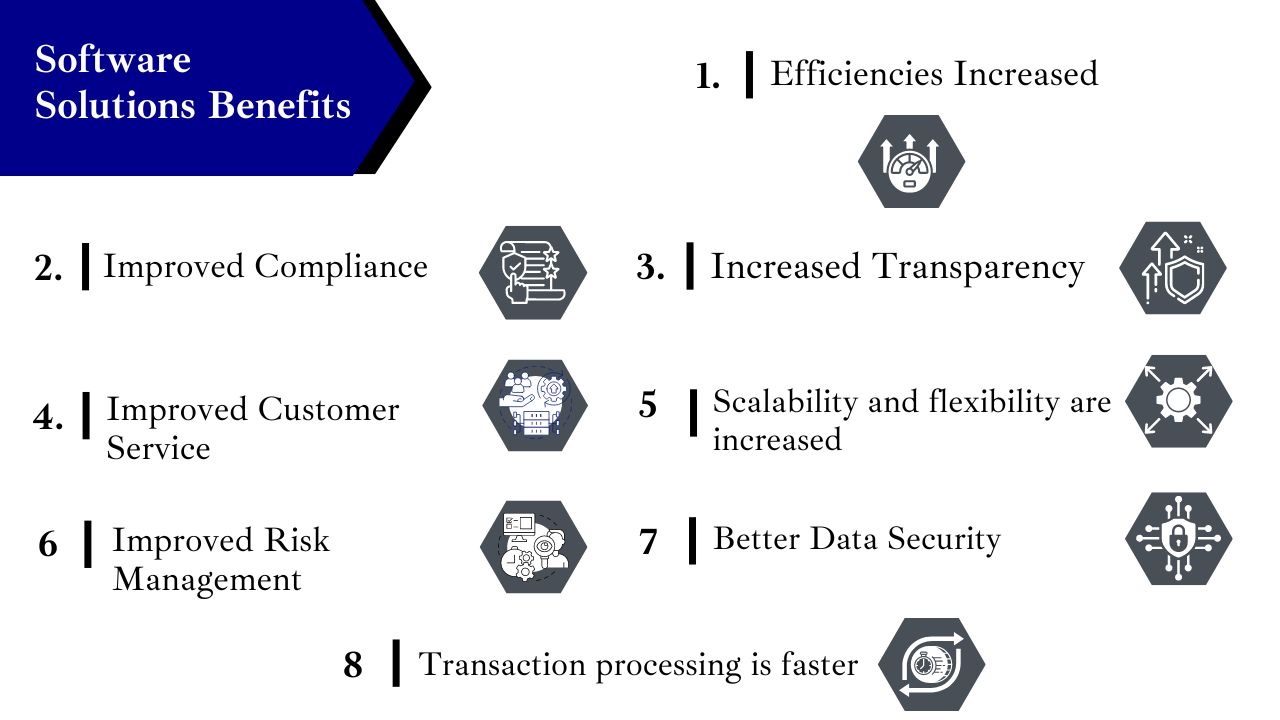

Insurance companies can reap many rewards from investing in customized insurance software.

It is a vital tool for businesses that want to stay competitive.