This year, leading MGAs will forge ahead through strategic partnerships, exceptional customer experiences, innovative products, and cutting-edge technology. This tech investment will be the game-changer, shaping the competitive landscape for years to come.

Here's a glimpse into the crystal ball of 2024, revealing four key predictions for MGAs:

1. Tech-Powered Partnerships: An Unstoppable Force

The Landscape: Excess & surplus (E&S) premiums have exploded, fueling the ascent of MGAs. Their agility, lean operations, and underwriting prowess grant them a sustainable edge. However, 2024 marks a new chapter: powerful partnerships with tech-forward carriers will propel them to unassailable heights.

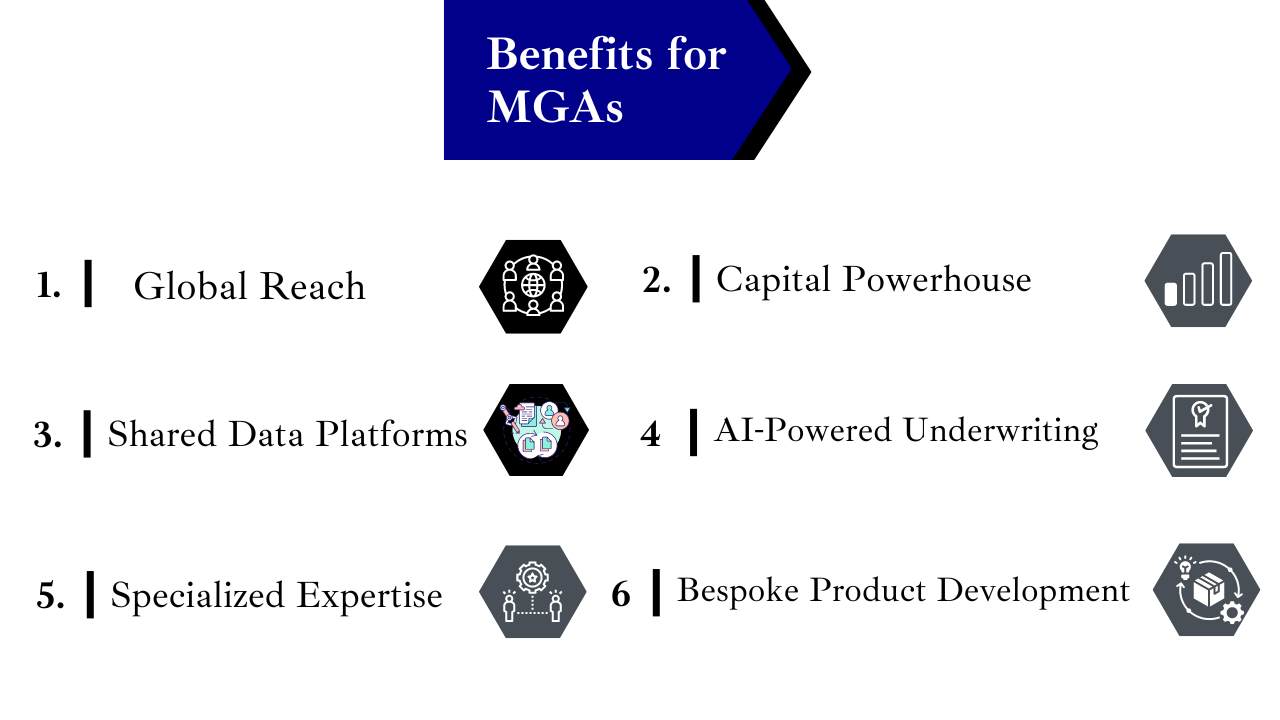

Benefits for MGAs:

- Market Expansion & Growth Acceleration:

- Specialized Expertise: Partner with carriers boasting niche expertise in areas beyond your reach, expanding your portfolio and attracting new customers.

- Global Reach: Leverage carrier distribution networks to access international markets and tap into untapped growth potential.

- Capital Powerhouse: Gain access to the carrier's capital strength, enabling you to write larger policies and venture into previously inaccessible markets.

- Data-Driven Insights & Bespoke Products:

- Shared Data Platforms: Collaborate on building cutting-edge data platforms, unlocking valuable market insights and trends.

- AI-Powered Underwriting: Partner to develop AI models that refine risk assessment and pricing, leading to more competitive offerings.

- Bespoke Product Development: Combine your niche expertise with the carrier's data and distribution muscle to create market-leading, customer-centric products.

Why Carriers Love Them:

- Hard Market Advantage: MGAs thrive in hard markets, offering carriers specialized expertise and underwriting skills to navigate challenging conditions.

- Proven Profitability: Consistent profitability makes MGAs attractive partners, mitigating risks for carriers looking to expand their offerings.

- 43% and Counting: Already, 43% of top US carriers leverage MGA partnerships, and this number is steadily rising as hard markets persist.

Beyond Carriers:

The future extends beyond traditional carrier partnerships. Consider:

- InsurTech Startups: Collaborate with cutting-edge insurtech players to access innovative technologies and reach new customer segments.

- Data Providers: Partner with data providers for enhanced risk insights and market trends, enriching your underwriting capabilities.

- Complementary MGAs: Forge alliances with MGAs in non-competing niches to cross-sell products, share expertise, and amplify your market reach.

2. Superior Customer Experience: The MGA Superpower

Forget legacy burdens! MGAs wield a distinct advantage - agility. Unbound by outdated systems, they can readily embrace intuitive technologies, transforming customer experience into their 2024 superpower. Here's how:

Beyond Interfaces:

- Personalized Portals: Imagine a customer portal tailored to individual needs, showcasing relevant policies, claims history, and easy access to communication channels.

- Omnichannel Engagement: Seamlessly transition between web, mobile app, and even offline interactions, offering consistent support wherever the customer chooses.

- Conversational AI Chatbots: Implement AI-powered chatbots for 24/7 support, answering basic inquiries and streamlining simple tasks.

Content Management Revolution:

- Intelligent Workflows: Automate repetitive tasks like policy renewal notifications and claims status updates, freeing up human agents for complex inquiries.

- Dynamic Content Delivery: Utilize data to personalize content on the fly, showcasing relevant products and services based on individual needs and risk profiles.

- Self-Service Empowerment: Equip customers with self-service tools for policy management, claims reporting, and payment options, fostering autonomy and convenience.

Data-Driven Insights, Personalized Service:

- Predictive Analytics: Leverage data to anticipate customer needs, proactively offering relevant solutions and preventing potential issues.

- Micro-Segmentation: Divide your customer base into smaller, targeted groups, enabling you to tailor communication and offerings with laser precision.

- Sentiment Analysis: Analyze customer feedback through social media and surveys to understand their concerns and improve your service accordingly.

InsurTech Powerhouses:

- Partner for Innovation: Seek strategic partnerships with insurtech companies specializing in customer engagement, claims automation, or data analytics.

- Best-in-Class Platforms: Integrate cutting-edge technology into your operations, offering your customers a seamless and engaging experience.

- Stay Ahead of the Curve: Collaborate with insurtechs to access emerging technologies and remain at the forefront of customer experience innovation.

3. AI-Driven Underwriting: Hyper-Specialization on the Rise

Tech's impact goes beyond partnerships and customer experience. MGAs are already carving out profitable niches, and 2024 will see AI take this specialization to new heights.

AI's power for MGAs:

- Advanced analytics and data to pinpoint lucrative sub-segments within existing niches.

- AI models trained on niche-specific data for deep understanding of risk and new markets.

- Launching niche-specific products that perfectly meet target market needs.

Think: Drones, autonomous vehicles, space tourism, and social impact!

This hyper-specialization:

- Reduces competition and aligns risk appetite.

- Overcomes underwriting challenges and facilitates quick quoting/binding.

- Positions MGAs as leaders in a world demanding specialized coverage.

4. Operational Efficiency: Doing More with Less

While some predict a favorable 2024, hard market conditions are likely to persist. This means optimizing efficiency will be crucial for MGAs.

Their tech-driven strategy:

- Automating workflows and streamlining underwriting processes.

- Moving away from paper towards cloud-based systems.

- Partnerships with non-competing MGAs and InsurTechs for shared solutions and resources.

The silver lining of a hard market:

- Strengthens carrier partnerships as they struggle with tighter underwriting conditions.

- MGAs are positioned as the ideal solution to evolving market needs and coverage gaps.

2024: A Year of Unlocking Potential

Join forces, win customer loyalty, specialize relentlessly, and embrace tech. This roadmap will power expert underwriting, efficient operations, and ultimately, propel MGAs to the forefront of the insurance landscape in 2024.

Ready to unlock your full potential? The future is calling!