The advances of Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the business world and the field of insurance isn't a different one. The industry was once thought of as cumbersome and slow-moving, the insurance industry is now using AI to simplify complicated processes, improve customer service, as well as making better decisions.

For professionals in the field of insurance or business owners as well as tech enthusiasts, knowing the importance in the use of AI and ML within the insurance industry is crucial.

If you're looking for ways to streamline processes, enhance customer experience or stay ahead of current trends this blog will take you through the most current applications, benefits, and challenges and the exciting future that lies ahead for AI within the financial sector.

The insurance industry is going through changes. In the past, policies or claims as well as underwriting have required a lot of documents, manual review, as well as human intervention. But these procedures aren't always effective and are susceptible to human mistakes. Additionally, changing customer expectations need a faster and more personalized services. This is something that traditional methods can't provide.

To deal with these issues, insurance companies are increasingly relying upon AI as well as ML to enhance their processes. They are anticipated to increase efficiency, cut costs and increase the accuracy of their decisions. They offer opportunities to identify the dangers promptly as well as avoid fraud. They also offer exceptional customer service and are essential aspects in a market that is primed for disruption.

Before we explore their applications, let's define these terms simply.

Insurance sector technology uses these techniques to analyze massive quantities of information, automate processes and provide customized solutions.

AI in the field of insurance has quickly developed over time. At first, it was employed for basic automation, like handling claims or answering simple customer questions using chatbots. As time passed, it shifted into more complex, value-added areas such as personalization, predictive analytics and even fraud-detection.

For instance, AI is now enabling insurance companies to develop specific policies for their customers according to their lifestyle as well as their purchase history and the patterns of their behavior.

ML models give insurers precise risk forecasts, assisting them make better underwriting decisions. AI improvement in insurance is designed to improve the quality of service and make it easier for humans to avoid mistakes.

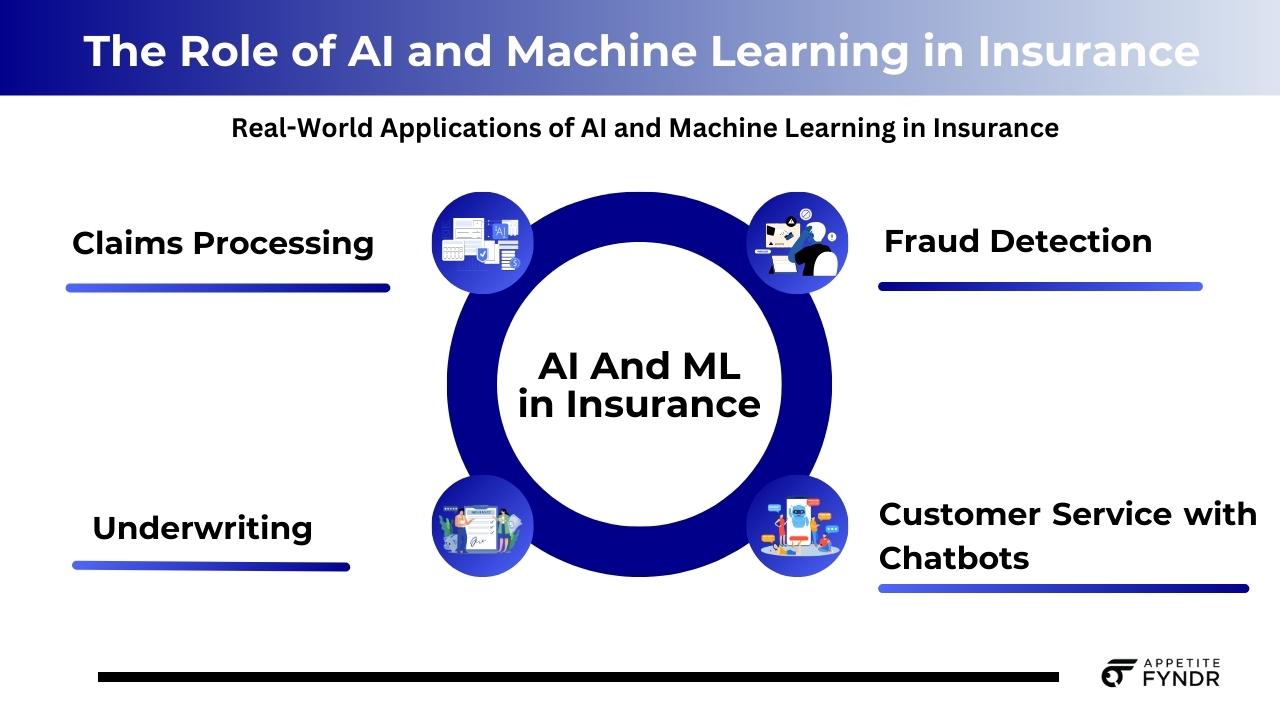

Below are the ways that insurance firms have making use of AI and ML efficiently:

AI-powered software is able to process claims in fractions the time that it would take for a human. AI-powered software can, for example, analyze photos of damage quickly to calculate repair costs and payments within hours in auto accident claims.

Underwriting was traditionally an arduous and manual process. AI tools such as predictive analytics are being utilized to evaluate risk profiles based on huge data sets, which results in quicker and more accurate underwriting decisions.

Every year, fraud costs billions of dollars However, the methods for detecting fraud manually are inefficient and slow. AI models can detect suspicious claims by recognizing patterns that are typically related to fraud. For example, an unusual rise in claims from a specific location could lead to an investigation that is more thorough.

AI chatbots, like those powered by NLP (Natural Language Processing) can speed up customer interactions. They are able to respond quickly to queries related to policies, help in the resolution of claims, and aid customers with purchasing insurance.

AI analyzes the individual data of customers to tailor insurance premiums. For instance, certain auto insurers make use of telematics data, such as vehicle information, to adjust prices based on driving habits, which result in more affordable prices.

What lies ahead for AI as well as ML in insurance is looking promising. Here are some things to be watching:

Are you considering integrating AI into your insurance business? Here are a few simple steps you can take to start with the least risks and the greatest impact:

AI machines and AI are revolutionizing the industry of insurance remarkable ways. These advanced tools improve efficiency, increase accuracy, predict risks, and enhance customer experiences--creating endless opportunities for growth.

However, adopting AI effectively requires cautious preparation, ethical considerations and a commitment to continuous technological advancement. If you take the time to think about these things today the insurance industry as well as business leaders can establish themselves as leaders in the technologically driven future.

Have you begun your AI journey yet? There's no better time to start than right now!