Small-scale businesses require commercial insurance is more than just making sure they're covered but it's a lifeline. Without proper insurance, any accident, lawsuit, or natural disaster could cause your company to go into financial ruin. Although insurance is vital, but the process of putting commercial insurance in place has its own set of challenges.

Insufficient insurance, overinsurance or premiums that aren't affordable? These challenges can make business owners feel unhappy and at risk. What's the good news? By confronting these issues directly, you will lead to better outcomes, less risk, and a greater feeling of safety.

This blog focuses on the most significant problems in commercial insurance the most important aspect is to figure out the best method to conquer these issues.

Suppose you're a smaller-scale business owner who is looking to buy your first insurance, an agent looking to offer you a better price or a risk management professional trying to strike a risk. In that case, this is the guide to making a successful purchase.

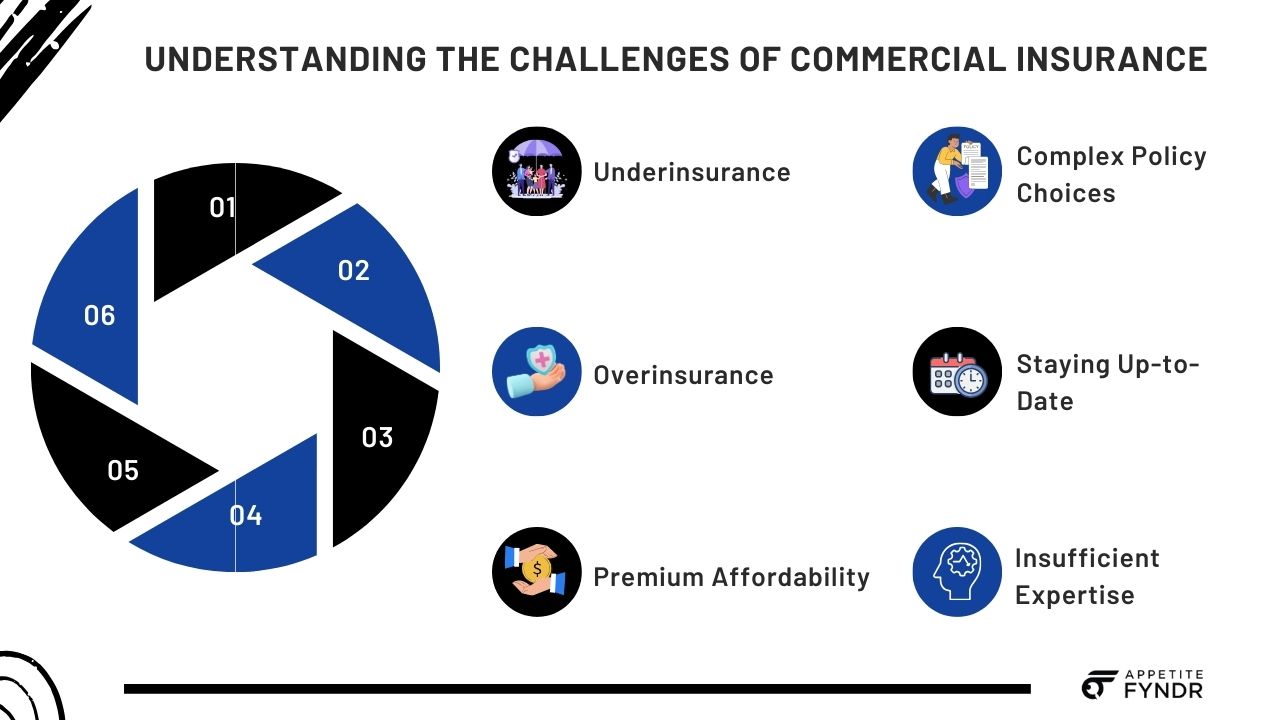

Commercial insurance might seem to be a simple procedure: identify risks, buy insurance and repeat. However, it's not always that simple. Here are the most frequent issues that hinder the implementation of a proper coverage.

One of the greatest dangers is not having enough insurance to completely protect your assets. Imagine your warehouse that is worth $1 million is destroyed and your insurance policy maxes at $500,000. Insufficient insurance leaves your company vulnerable to financial loss that is massive.

On the other hand the other hand, overinsurance can be a dangerous slope. Imagine having to pay premiums for coverage that you don't require for obligations that aren't relevant to your company. It's an unnecessary expenditure of money and resources that no small business owner could afford.

Commercial insurance premiums may feel like a huge drain on your financial resources. The rising costs make it difficult for small-sized businesses to keep complete coverage while managing other costs.

The fine print in insurance policies could leave business owners overwhelmed. What's A-rated? What's excluded? These information is often hidden in jargon, which makes it easy to miss the actual coverage you're purchasing.

Market trends, regulations for insurance and risk exposures are evolving continuously. Becoming informed of the latest developments is a issue, particularly for small-scale business owners carrying multiple hats.

The process of placing an order isn't only about choosing the best policy you find on the results of a Google search. Without guidance from an expert numerous people have a difficult time finding specialized and cost-effective options, which can result in either coverage gaps or astronomically high cost.

Finding the right equilibrium between overinsurance and underinsurance at the right level can be like walking on a tightrope. Here's how you can ensure that you're not over-insured.

Begin by identifying each potential danger your company faces. The assessment should be thorough and include operational, physical and liability risks. What is the probability? What is the recovery cost likely to be? Record everything.

A knowledgeable insurance broker can offer valuable insight tailored to your company's needs. Brokers assess your requirements to ensure that you're paying for insurance that is relevant and broad.

Companies expand, shrink and change. What worked this year might require re-evaluation this year. Check your policy frequently to ensure that it is in line with the current situation and risks levels.

Are skyrocketing premiums making you consider dropping coverage? Don't panic now. There are options to secure the protection you require without spending a fortune.

Insurance bundles are like receiving the value of a meal instead purchasing items separately. By bundling professional, general liability insurance, or any other requirements through a single provider you can get significant savings.

Insurance companies prefer clients with low risk. Install safety protocols as well as employee education programs and routine maintenance checks to minimize claims. A lower risk usually translates to lower insurance premiums.

The amount you have to take out of your pocket prior to the time that insurance coverage begins to take effect--has a significant impact on the cost of your insurance. Think about higher deductibles if you are able to handle it because it reduces initial cost of premiums.

The world of insurance isn't static. Regulations and risks, as well as marketplaces change constantly. Being ahead of these changes will save your business from headaches (and cash).

Be aware of major changes within your field that could impact the cost of insurance. For instance, companies in areas that are prone to flooding should keep an eye on the changes in the nature of coverage for natural disasters.

Be conscious of local, state laws or federal regulations regarding insurance for businesses. In ignorance, you'll be liable to the penalties for not complying.

If you see new risks, you should reevaluate your insurance policy. For instance, as cyber attacks become more sophisticated, determining whether you have cyber liability insurance that policy is in line with the latest threat levels is essential.

Expert advice and technology could make it easier to handle the heavy lifting that is required for commercial placement of insurance.

AI-powered platforms can help you understand your risk and recommend appropriate coverage more quickly than traditional methods. This means less doubt and more accurate suggestions.

Imagine brokers as translators proficient with "insurance-ese." They'll sift through the many options to find an insurance policy that will protect your business from unnecessary costs. In addition, they'll be able to be able to answer the unavoidable problem: "What does this policy actually cover?"

Commercial insurance can be a challenge and challenging, but it's one worth tackling. Through understanding the risks, carefully assessing policies and remaining up-to-date, you can safeguard your company while remaining within your budget.

Whether you're protecting your assets or ensuring that you meet legally binding obligations proper method will ensure that your business is successful regardless of uncertainty.

Start today by looking over your current coverage, minimize risks, and speak with an expert who is familiar with the details in commercial insurance. A business that is well-protected is more than just smart. It's the base for your future success.