Different states have different rules about business insurance, and insurance companies don't always use the same names for different types of coverage. One insurance company might call coverage for boilers, machinery, and other equipment that breaks down by mistake "boiler and machinery insurance," while another might call it "equipment breakdown coverage" or "mechanical breakdown coverage."

Another thing that can be hard to understand is that names like "boiler and machinery insurance" usually cover more than what they say, like computers and office equipment. Here is a list of some of the business insurance coverages that Nationwide offers to help you understand the different types of company insurance that are out there.

Businesses can purchase property and liability coverage with commercial lines insurance, keeping themselves protected against losses that would be too risky to bear themselves, while still enabling them to do business as usual. You can compare commercial plans to personal lines insurance.

Workers' compensation insurance, commercial car insurance, federal flood insurance, aircraft insurance, ocean marine insurance, and medical malpractice insurance are all types of commercial lines insurance. Businesses don't have to worry about losing money because of accidents, lawsuits, or natural events when they have commercial lines.

Coverages and premium prices depend on the nature, size and location of a business. In 2022, an insurance contract typically cost $42 monthly for professional liability and $70 monthly for workers' compensation coverages.

Each insurance is made to fit the needs of the client and the type of business it covers.A structural engineering firm may need professional liability insurance to guard itself against claims of negligence when creating building plans, inspecting them for construction purposes and overseeing their build process. Furthermore, general coverage could be purchased per project in addition to punitive losses coverage.

A small business run out of a person's home might need more than one professional line of insurance because homeowner's insurance doesn't cover business activities very well or at all. A home-based business might need commercial auto insurance for a delivery vehicle owned by the business, worker's compensation insurance for the person driving the vehicle, property insurance to cover business goods stolen from the home or vehicle, and liability insurance to protect the business from claims by customers who say the product they bought hurt them.

Liability, property and workers' compensation insurances are three popular forms of business insurance. Property coverage typically refers to damage done to your business property while liability and workers' comp protect others in case they suffer an injury during work activities. Based on your needs as an entrepreneur or small business owner, additional forms of protection may be essential; here are a few solutions that could protect all aspects of it all.

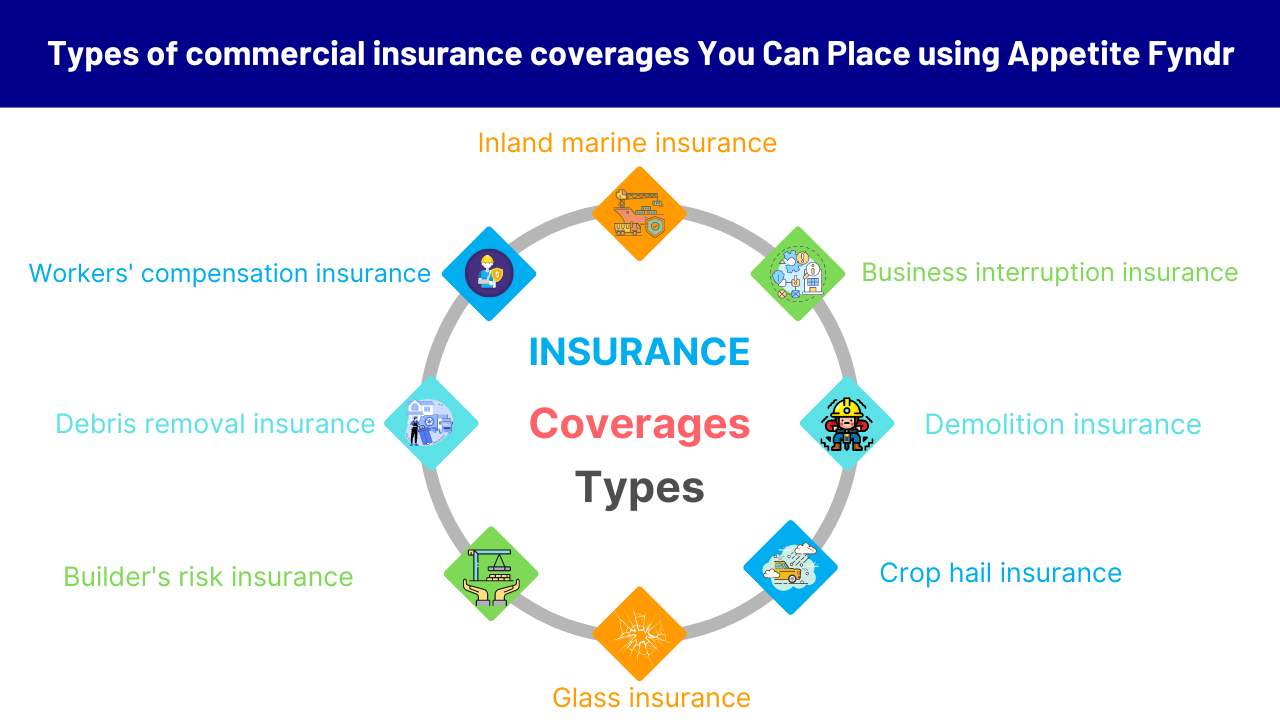

Insurance for employers that gives benefits to workers who get hurt on the job or become disabled because of their job is called workers' compensation.

When you have waste removal insurance, the company pays for the work that needs to be done after a disaster, like a fire destroying a building. The remains of the old building must be taken down before it can be rebuilt. Most of the time, property insurance won't cover the costs of cleaning up the mess.

Builder's Risk Insurance protects houses while they are being built.

Broken windows in a business are covered by glass insurance.

While goods are being shipped, inland marine insurance protects them, as well as other people's goods that are on the business property. This insurance would pay for damage to a customer's clothes caused by a fire at a dry cleaner.

Business interruption insurance pays for lost profits and costs caused by damage or loss of property. A fire could shut down a business for two months. This insurance would pay for the rent, salaries, taxes, and net profits that the company would have made during that time.

Demolition insurance covers the costs associated with demolishing buildings damaged by disaster, such as fire or storm. Zoning laws may dictate that damaged structures must be torn down rather than repaired, and demolition insurance covers this expense for parts of buildings that haven't been damaged as completely.

Crop hail insurance provides coverage against damage and losses caused by hail and fire, providing coverage while the crops remain in the field before being harvested by farmers who purchased it. Farmers depend heavily on sudden weather events for income; having crop hail insurance covers them should such a situation arise.

Factors to keep in mind include your type of business or job, number of workers and coverage needed in case of unexpected incidents.

General liability coverage is a type of commercial general liability (CGL) insurance that shields companies from claims of harm to people or damage to their property.

Workers' compensation, also written as "workers' comp," is a type of company insurance required by the government to help workers who get hurt or sick on the job or because of their job.

Even if you work from home, your small business needs property insurance and liability insurance at the very least. You'll need business vehicle insurance if you have cars for work. And if you have staff, most states will make you get workers' compensation insurance.

What other types of small business insurance you need depend on the type of business you have, its size, location, yearly sales, and number of years in business.

To make things easier for yourself, look for an insurance company you can trust and then look for coverages that are made for your industry.

Commercial lines insurance provides products tailored specifically for businesses. Malpractice, professional liability and builder's risk are just some of the losses covered by commercial lines policies. Companies operating out of someone's home may need professional coverage; homeowner policies don't usually extend coverage beyond these activities.

Appetite Fyndr provides the ideal commercial insurance coverage. Simply create an account and log in to the best insurance marketplace that suits your needs!