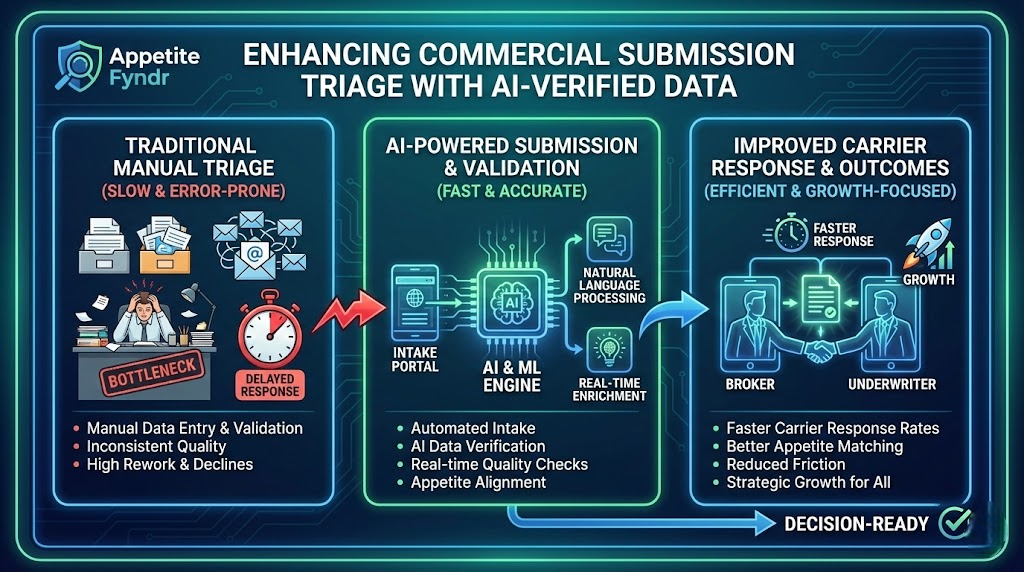

The speed and accuracy of commercial insurance decisions increasingly determine market competitiveness. As submission volumes grow and underwriting resources tighten, AI-verified data in commercial insurance submissions has become essential for improving efficiency, accuracy, and carrier engagement. Insurers and brokers who modernize submission triage gain faster responses, better appetite alignment, and stronger placement outcomes.

Poor data quality in today’s environment is considered to be fatal and acts as a direct barrier to carrier responsiveness. Using advanced AI will help to manage the submissions throughout the commercial insurance lifecycle.

Why Commercial Insurance Submission Triage Is Breaking Down

Most of the commercial insurance submission triage is dependent on the manual work which slows down the underwriting teams and increases the risk of misrouted or incomplete submissions. As a result of this, carriers receive low quality data and there is a delay in quoted timelines.

The actual issue of this breakdown is not only the issue but the lack of reliable validation at intake. In the absence of automation the underwriters have to spend their time on matching the submissions with the guidelines that further reduce the overall productivity.

How AI in Insurance Submissions Transforms Data Quality

The data which is collected through AI in insurance submissions is processed through machine learning and natural language models in a real time for validating and enriching. These models are capable of analysing the completeness and risk relevance before moving it to the underwriting stage.

This approach helps to improve the data quality in commercial insurance by highlighting discrepancies and missing data. The data which is later received by the carriers is reliable on which decisions can be made.

Automated Submission Validation as a Competitive Advantage

In the past the final draft of underwriting had a chance of misalignment with the guidelines but with automated submission validation the ratio of error is almost negligible. AI took up all the manual work related to verifying the external sources and confirming details so the submissions are now moved forward with predefined quality thresholds.

Insurance submission automation has sped up the placement process with the elimination of rework and back-and-forth communication. Similarly, carriers are now able to respond quickly when they trust the integrity of incoming data.

Improving Carrier Response Rates Through AI Data Verification for Insurers

It is generally observed that the response rate of carriers is significantly improved through data verification for insurers. When underwriters receive submissions that are already qualified then it will enable them to focus on pricing and risk selection rather than data cleanup.

Anyone who witnesses improving carrier response rates is due to the fact that carriers aligned their submissions with underwriting appetite. Faster responses also strengthen broker–carrier relationships and increase placement success.

Underwriting Triage Automation and Appetite Alignment

Advanced underwriting triage automation uses AI to evaluate risk characteristics and match submissions to carrier appetite models. Rather than sending the same submission to multiple carriers, AI has an ability to intelligently route it to the most suitable markets.

This capability plays a critical role in improving insurer appetite matching which ensures carriers receive risks they are more likely to quote. Better matching reduces declinations and improves overall market efficiency.

The Role of Digital Commercial Insurance Workflows

Fully integrated digital commercial insurance workflows allow AI-verified data to flow seamlessly from intake to underwriting. With the inclusion of automation the companies can not only handle data consistently across the systems but also eliminate silos that hurt the submission quality.

These workflows also provide transparency and enable insurers to continuously refine triage rules and appetite models. With the passage of time organizations which are using AI-driven workflows can achieve higher throughput without increasing underwriting headcount.

Strategic Benefits for Brokers and Carriers Alike

A broker who ensures that their submissions are accurate builds a strong credibility among the carriers. Similarly, the insurers can guarantee the validation utilizing AI that results in their growth. AI automation is helping both brokers and carriers to make faster decisions and improve the overall operational efficiency.

AI-verified data in commercial insurance submissions becomes a foundational capability which is allowing the companies to do more with less in order to meet industry requirements.

Conclusion: The Future of Commercial Submission Triage

As the future growth for every industry is now based on AI, so is the case with commercial insurance. Organizations that are now implementing AI in insurance submissions and prioritizing automated submission validation are on the safer side of shore than those who are following the manual processes.

Still thinking that today is the right time for insurers and brokers to modernize their submission strategies by investing in AI-driven triage? The answer is “Yes” and if your organization is ready to improve response rates and underwriting performance adopting AI-powered submission workflows should be your next logical step.