Like every other industry, market speed determines the win rates and the same is the case in the insurance industry. Faster digitizing request for appetite in insurance has now gone beyond innovation and become a strategic necessity for every company. The older ways of assessing the risk appetite and placing commercial coverage are slow and involve manual work that result in delayed underwriting decisions. To cope with the modern insurance demands digital request for appetite insurance workflows must be shorter in decision cycle and highly accurate for both underwriters and brokers. This shift not only enhances operational excellence but also accelerates speed to market in commercial insurance.

Why Do Traditional Appetite Requests Slow Down Placement?

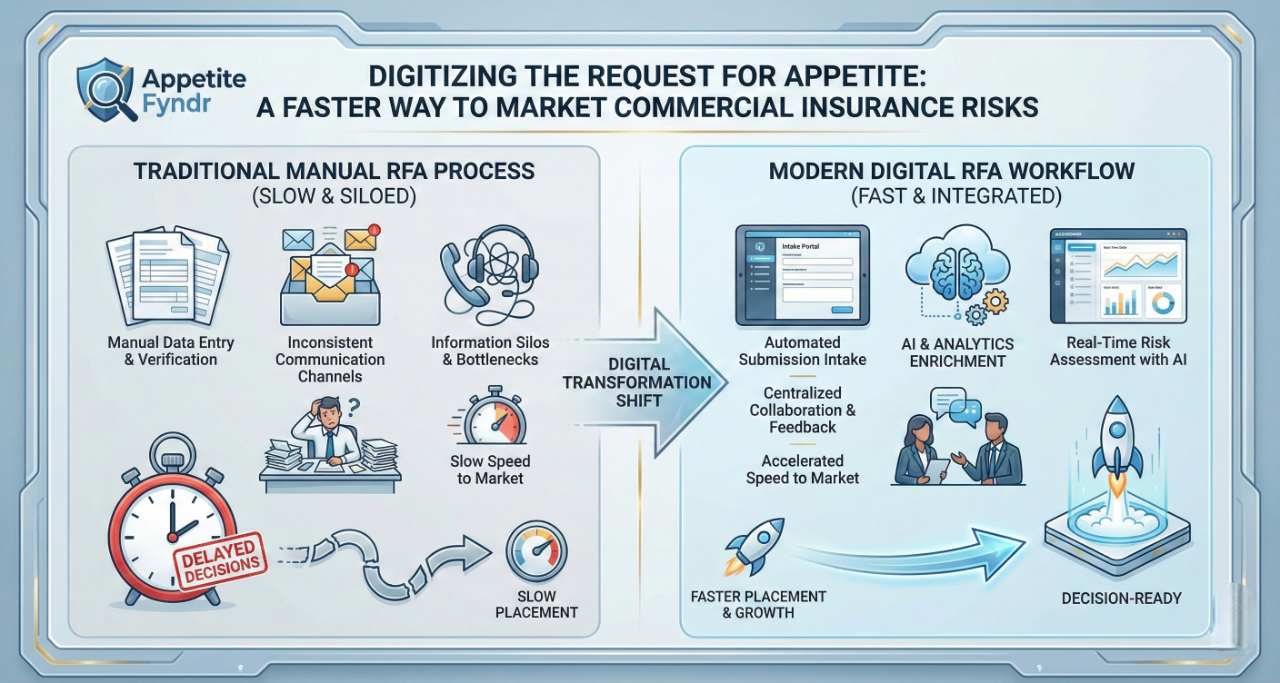

Historically, the insurance RFA process has relied on manual work and inconsistent communication channels between the stakeholders. Brokers collect risk details in multiple formats due to which underwriters have to spend considerable time to recheck and manually verify the data against the appetite criteria. These inefficiencies created bottlenecks in commercial insurance placement and delayed the final delivery.

In the insurance underwriting communication tools the insurance teams are unable to communicate effectively and commit losses. If the teams are not sync to standard intakes and decision support they can duplicate the work easily. For this reason they are also not able to do a higher-value analysis.

What Does a Digital Request for Appetite Insurance Workflow Look Like?

Modern platforms automate submission intake and streamline the request for appetite automation process end-to-end. Instead of sending unstructured PDFs and emails, brokers enter structured risk data into a digital intake portal. With this automated approach they ensure that all the guidelines are being followed before forwarding the submissions to underwriters.

Similarly this enabled the carriers to quickly compare the risk profiles against the defined appetite criteria and surface the decision-ready opportunities. Real time data enrichment could also be performed for more accurate risk assessment. This is usually done by pulling in external analytics, risk scores, and relevant guidelines. Utilizing the digital tools insurance teams can process more submissions with accuracy.

How Does Automation Accelerate Commercial Insurance Placement?

Automation fundamentally improves commercial insurance placement automation by reducing manual work and enabling more efficient workflows. With AI-powered tools underwriters spend less time on administrative duties and make strategic decisions based on extracted data.

Automated workflows also allow parallel processing of tasks that were carried out manually in the past. Any one can validate the risk profile, compliance with the appetite rules and prioritize underwriting reviews using multiple workflows at a time. This orchestration dramatically improves efficiency and enables risk teams to deliver binding decisions in a minimum time span.

Additionally, automated workflows allow parallel processing of tasks that once happened sequentially. For example, while one system validates the risk profile, another can check compliance and appetite rules, and a third can queue prioritized cases for underwriting review. This orchestration dramatically improves efficiency and enables risk teams to deliver binding decisions in hours rather than days or weeks.

Can Digital Tools Improve Collaboration Between Brokers and Underwriters?

The answer is always “Yes”. Digital platforms are capable of turning the communication silos with structured workflows and shared status from team members. Modern systems can centralize the interaction around each submission that allows the brokers and underwriters to remain synchronized for any recent update. This unified approach enhances transparency and reduces back-and-forth emails that traditionally slow the insurance RFA process.

With these systems underwriters can flag missing information directly in the platform, and the broker receives instant feedback. This way teams are able to reduce friction and stick around common objectives.

What Role Do Analytics and AI Play in Appetite Decisions?

Advanced analytics and AI are catalysts for transforming how risk appetite is carried forward. Intelligent systems can analyze thousands of historical underwriting decisions to generate context-aware recommendations to support quick risk selection. Integrating the predictive model within digital insurance placement workflows will tell why the submitted files are according to the appetite criteria along with the history of risk performed.

This real-time data allow the carrier to adjust appetite parameters accordingly by reviewing the trends and balance portfolios. Analytics also supports continuous improvement to refine appetite thresholds and accelerate decisions as market conditions evolve.

Why Speed to Market Matters More Today Than Ever?

Faster placements considered to be a competitive advantage because brokers and carriers that expedite underwriting experience better outcomes. Today companies cannot bear delays because clients are expecting quick responses and real-time visibility into their policies.

Digitized and automated placement processes create a virtuous cycle of responsiveness and quality. It boosts client satisfaction and enables carriers to scale without proportional increases in staff.

How Can Carriers Begin Their Digital Transformation Journey?

To begin with the digital transformation journey, carriers must start with clarity on guidelines. They have to begin with the digitized intake and structured workflows for broader transformation across the underwriting value chain. Later on theory can embed decision support tools, analytics, and AI to enhance precision and risk selection quality. Furthermore, continuous education, iterative improvement and alignment between business and technology teams ensures sustainability.

Conclusion: Embrace the Future of Commercial Insurance

In a world where agility has become the key to success, the digitalization of request for appetite in the insurance sector ensures a noticeable improvement in the efficiency of business workflows, risk selection, and the speed of going to market in the commercial insurance sector. The potential of the insurance RFA process has now been unleashed by adopting automation and communication tools.

This change is not something that carriers can choose whether or not to implement but it is the fundamental factor to remain relevant and responsive in this fast-paced market. Invest in digitized appetite workflows today and position your commercial insurance operations for the future of digital engagement and market leadership.